Do You Have the Right Financial Team in Place?

Planning for retirement isn’t a solo mission. At least, it shouldn’t be.

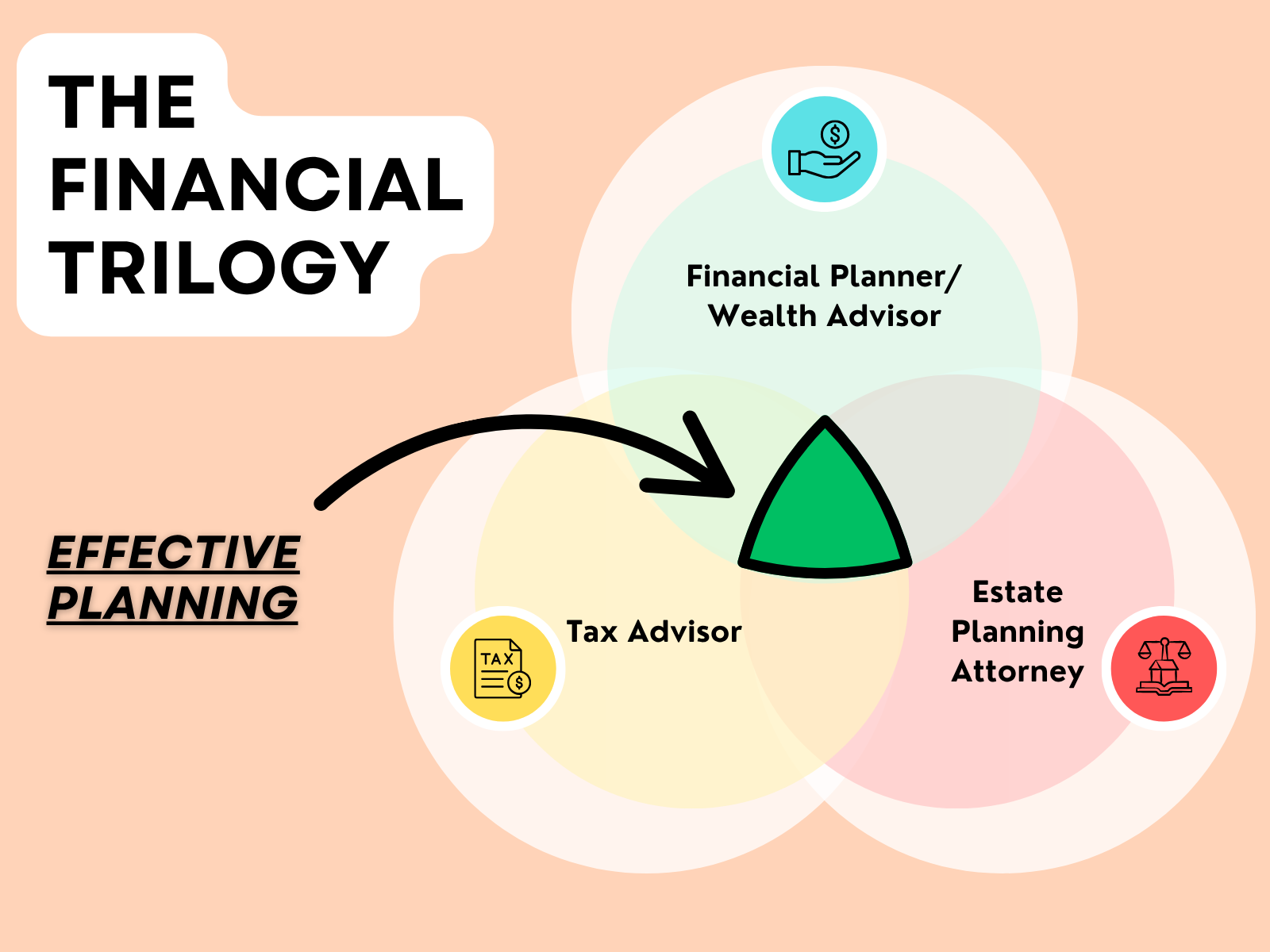

Those best-positioned to succeed typically have developed a team around them to help coordinate their financial pieces, from investments to tax planning and estate planning, and much more.

Before we get into things, a quick story-

Over the last couple of years, I’ve developed a deep infatuation with golf. (I’ll save that diatribe for another day..)

For those who play golf, you wouldn’t step onto a golf course without your full set of clubs.

Each one has a specific purpose: the driver gets you distance off the tee, the irons and wedges are for precision approaching the green, and the putter for finesse to get the ball in the cup.

If you were to try to play a full round of golf with just one or two clubs, even the world’s best golfers would really struggle.

For the non-golfers, pick any team sport or group activity of yours: football, baseball, pickleball, band/ orchestra, choir, or even a company project.

In each of these, success rarely comes from one person doing everything.

It comes from the right people in the right roles, working together toward a shared goal.

Retirement is no different.

Sure, you can try to handle your investments, taxes, estate planning, income strategy, and healthcare decisions on your own.

But you’re likely not an expert in any of those areas, and there are plenty of reputable, qualified professionals who can help you coordinate your various financial pieces so that you can get what you want out of life in the most efficient way possible.

Oh, and they’re far more likely to identify the blind spots in your financial situation, because let’s face it, we’re all prone to biases that cloud our judgment and make it hard to see things clearly when it comes to our own lives.

That’s why having the right team matters!

Who should be on your financial team?

1. Financial Planner/ Wealth Advisor (Preferably a CFP®)

This is your central financial “guide”.

This person helps you evaluate every financial decision needing to be made so that you can make the most informed decisions possible.

They help to coordinate all of your financial team to ensure that there are no gaps.

Ideally, this person should check the following boxes (just to name a few):

Has obtained advanced certifications (such as the CFP®)

Has a clean compliance record, which can be found on this SEC page.

Specializes in working with people in your same situation or phase of life.

Can succinctly communicate the value in working with them and how they are compensated.

2. Tax Professional (CPA or EA)

A knowledgeable tax professional helps you do more than just file your federal and state tax return.

They can help you avoid unnecessary penalties, time your income wisely in retirement, and take advantage of strategies like Roth conversions, tax bracket management, and charitable giving.

Ideally, this person should have an advanced certification such as a CPA license or EA designation.

3. Estate Planning Attorney

Your estate plan ensures your wishes are known and respected, both during your life and after.

They help you do effective planning so that your heirs keep more and pay less (or no) estate taxes.

From wills and trusts to powers of attorney and healthcare directives, a good estate attorney helps protect your legacy and gives your loved ones clarity when they need it most.

They help you ensure that all your assets and beneficiaries are titled and listed correctly, and that your legacy endures far after you’re no longer here.

4. Insurance/ Medicare Specialist

A critical part of retirement is managing the risks that could disrupt your financial security.

Whether it’s navigating Medicare options, evaluating long-term care needs, or reviewing life, and health insurance, this specialist helps ensure you’re protected from the unexpected.

Ideally, you work with a “broker” who has several insurance companies that they can shop on your behalf, and the broker’s commission doesn’t drastically vary given the company that they place you with. You want your professionals to have as few conflicts of interest as possible.

And here’s the key: Your professionals have to be regularly communicating and aligned on your behalf

Your team needs to be aligned. It sounds pretty simple, but you’d be surprised at how often this doesn’t happen.

Your advisor and CPA should be communicating frequently. Tax planning strategies should be discussed by both parties in a collaborative manner. That way, both professionals are coordinating effectively on the planning around your investments, income, and taxes.

Your estate attorney should not only help you draft your documents, but also help ensure that accounts are retitled, beneficiaries are updated, and trusts are funded. Once again, your advisor and attorney should be coordinated on this effort.

I refer to the financial advisor, CPA, and estate planning attorney as the “Financial Trilogy”. They are the core building blocks of one’s financial team.

When your professionals aren’t operating in this manner?

You may miss opportunities, pay more in taxes than necessary, or leave your family with a mess later on.

So… who’s on your team?

Do you have the right people in place?

Are they regularly engaging in dialogue?

And are they all working toward your financial/ life objectives?

If you’re not sure, or you’ve been carrying the whole team on your back, that might be a reason to consider making a change.