Do You Have the Right Investment Strategy?

Too safe? Too risky? The right investment strategy strikes a balance.. is yours working for you?

When it comes to investing, most people assume that merely investing in a 401(k), IRA, or brokerage account means they have a strategy.

However, I’d argue that there’s a big difference between owning investments and having a well-thought-out investment strategy.

The right strategy is less about targeting the highest investment return possible and more about making sure your money supports you lifestyle, financial goals, and the retirement you envision.

The Purpose of an Investment Strategy

A true investment strategy isn’t about picking the hottest fund or predicting what the market will do next. It’s about building an informed investment plan around a few key questions:

What is the purpose of this money? (Long-term retirement dollars? Shorter-term purpose like buying a home? Funding college education for kids or grandkids?)

How much risk am I comfortable taking, and how much do I actually need to take?

How do my investments coordinate with my tax plan, withdrawal strategy, and estate plan?

Your answers to these questions form the foundation of an appropriate investment strategy.

What Happens If I Haven’t Defined One?

“If you haven’t clearly defined an investment strategy, then you’re ‘driving blind.’ You might still be moving forward, but without a map, you risk taking wrong turns or ending up somewhere you didn’t intend to go.

An investment strategy gives you direction.

It tells you not just what you own, but why you own it, how it fits your financial objectives, and when it should change. Without it, you’re relying on chance.

Here’s what might happen:

Too Conservative

It’s natural to want to protect what you’ve worked so hard to build. Many retirees and near-retirees move heavily into cash or bonds, thinking safety is the smartest move. The problem?

Playing it too safe exposes you to a silent risk: inflation.

If your portfolio earns 3% but your cost of living rises 4% due to inflation, you’re actually losing ground each year.

Over a 30+ year retirement, that gap can seriously erode your assets and your lifestyle.

“Safe” isn’t always safe if it means your money can’t keep up with your expenses.

Too Aggressive

On the other end of the spectrum, some investors stay heavily in stocks because they fear missing out on growth. And while equities do provide growth over the long term, retirement is different. You’re no longer just saving — you’re withdrawing.

If the market drops 20% and you’re forced to sell shares to cover living expenses, those losses lock in permanently. Unlike in your working years, you don’t have new contributions coming in to smooth it out.

Another common mistake? Overconcentration.

Holding too much in one asset class (like U.S. large-cap stocks) or even a handful of individual stocks can magnify your risk. Diversification often feels “boring”, but it does the job. It’s what helps smooth out the ride and protect your retirement assets when certain parts of the market stumble.

Being too aggressive can create unnecessary stress and potentially cause real damage to your long-term financial plan.

No Coordination

Even a well-diversified portfolio can cause problems if it isn’t tied into the bigger picture of your financial plan.

For example, you might have the right mix of stocks and bonds, but if you’re withdrawing from the wrong accounts, you could be creating unnecessary tax bills. Pulling too much from a pre-tax account in one year could push you into a higher bracket, trigger Medicare IRMAA surcharges, or reduce eligibility for certain credits and deductions.

Required minimum distributions (RMDs) add another layer of complexity. If you haven’t planned for them, you may end up taking larger taxable withdrawals than you need, which can ripple into other areas of your financial life.

There’s also the question of cash flow alignment.

If your investments aren’t structured to match your actual spending needs, you could find yourself selling growth assets during a downturn just to cover monthly expenses. That’s where strategies like bucketing or setting aside a dedicated cash reserve come into play, ensuring your income is steady while giving your growth assets time to recover.

In short, having a solid investment strategy without coordinating them with taxes, income needs, and your retirement goals is like having a great engine but no steering wheel. The power is there, but you’re not in control of the direction.

What the Right Strategy Looks Like

The right investment strategy isn’t a one-size-fits-all formula.

It’s about designing a plan that incorporates how much income you’ll need, how long you expect retirement to last, and what level of risk you can take without losing sleep.

At its core, a sound retirement strategy blends:

Growth assets (like stocks): These are what keep your portfolio moving forward over the long term. Retirement can easily last 20–30 years, which means you need a portion of your money to keep pace with — and ideally outpace — inflation. Without growth, your purchasing power erodes.

Income and safety assets (like bonds and cash): These provide stability and liquidity. Having a reliable “cushion” to cover several years of expenses helps you avoid selling stocks in a downturn. Bonds can generate steady income, while cash reserves ensure you’re not forced to liquidate growth assets at the wrong time.

Tax coordination: Not all withdrawals are created equal. A thoughtful mix of pre-tax, Roth, and taxable accounts gives you flexibility. By pulling from the right account at the right time, you can minimize lifetime taxes — sometimes by hundreds of thousands of dollars.

Flexibility: The right strategy isn’t set in stone. It adjusts as markets, tax laws, and your personal circumstances change. What works at 62 may look very different at 72.

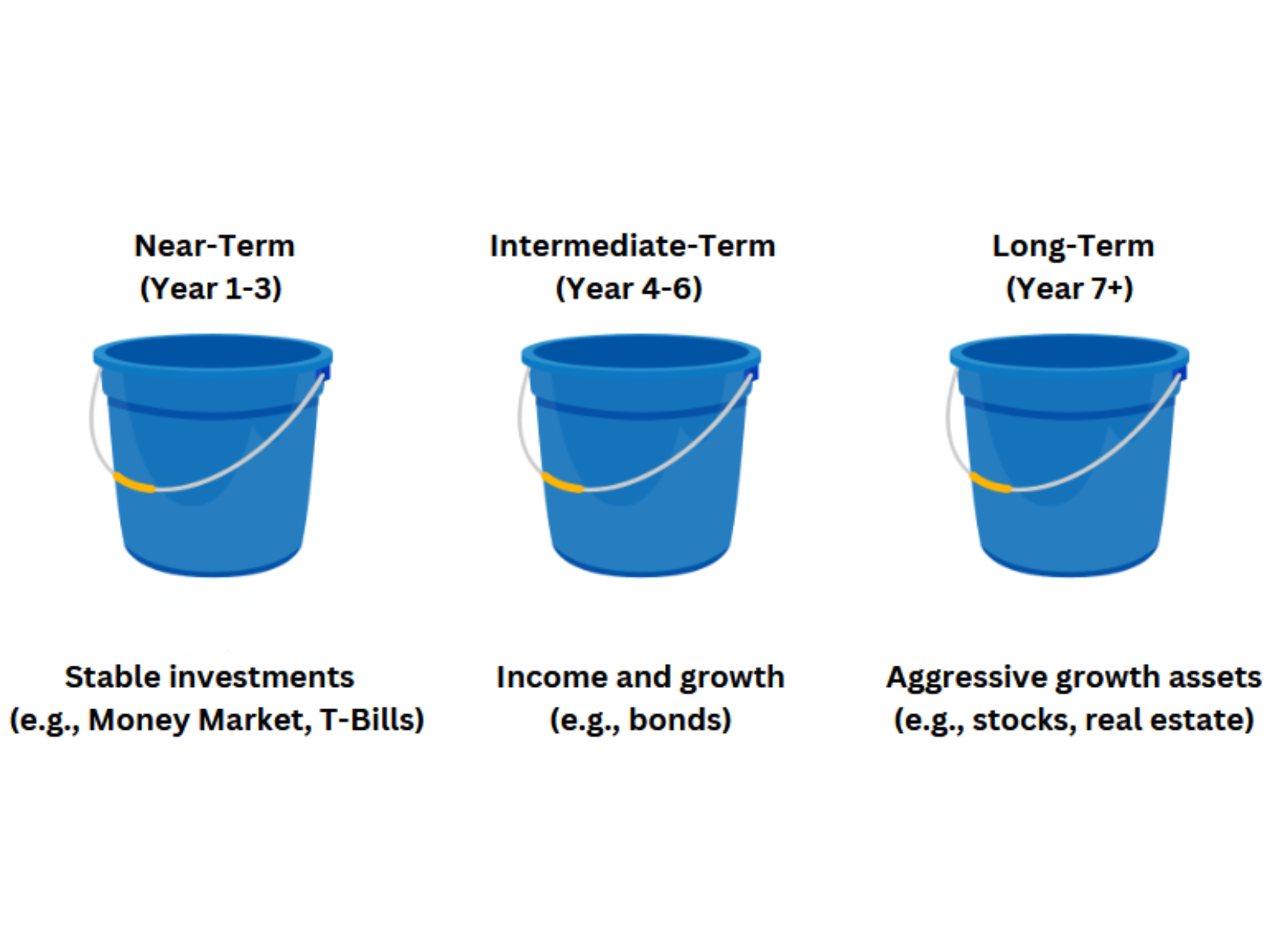

One practical framework my retirees find helpful is the “bucket strategy.”

Here, you divide assets into time horizons:

Bucket 1: Cash and ultra-safe investments to cover the next 1–3 years of expenses.

Bucket 2: Bonds and balanced funds for medium-term spending needs.

Bucket 3: Stocks and growth assets for long-term needs, where volatility is acceptable because you won’t need the money for many years.

This way, you’re not panicking when the market dips. Your short-term needs are protected, and your long-term money can keep working.

Closing Remarks

Having the right investment strategy isn’t about picking winners or timing the market. It’s about making sure your money is aligned with your goals, your tolerance for risk, and your overall financial plan.

So, do you have the right investment strategy?

If you’re not sure, that’s okay. Many people don’t.

And that’s where financial planning comes in. By tying your investments to your income, taxes, and future goals, you can build a strategy that supports your retirement with confidence.