Financially Speaking: The Blog

Retirement focused education to help you thrive.

4 Retirement Updates to Know for 2026 ⭐

Four key retirement updates for 2026 that affect how retirees and near-retirees save, give, and manage taxable income- including new senior deductions, catch-up rules, charitable giving changes, and higher contribution limits.

What is the Best Age to Retire?

What’s the best age to retire? A data-driven and real-life look at when retirement makes the most sense.

The Best Financial Resources I Recommend as a Financial Planner

A financial planner’s guide to the best books, blogs, podcasts, and resources for every stage of life, from early career through retirement.

Which Accounts Should You Withdraw From First in Retirement?

Which accounts should retirees withdraw from first?

We discuss the most tax-efficient withdrawal strategy that considers using taxable, IRA, and Roth accounts alongside Social Security income.

How Retirees Should View Crypto and AI in 2025

Retirees are hearing nonstop about crypto and AI. Here’s what actually matters for your money, your safety, and your long-term plan in 2025.

Can You Live Off Dividends in Retirement?

Many retirees love the idea of letting their investments pay their bills in retirement. You simply collect and spend your dividends, without ever touching the principal.

But thinking that way can grossly limit how you use your money to actually enjoy retirement.

The Science of a Happy Retirement

Most retirees think happiness comes from financial security, but the science tells a bigger story. Research shows that lasting fulfillment in retirement comes from three things: a solid financial foundation, strong relationships, and a sense of purpose.

The 10-Year Window That Can Make or Break Your Retirement

The decade surrounding retirement, five years before and five after, can make or break your long-term success.

In this article, Charles Petitjean, CFP®, explains why this 10-year window is the most critical for retirees, and how smart tax moves, spending strategies, and investment positioning can secure a lifetime of financial confidence.

What’s the Biggest Risk to Your Retirement Today?

Retirement isn’t just about saving enough. The biggest risks, like inflation, market volatility, taxes, and health costs, can derail your plans if you’re not prepared.

Learn how to build a flexible retirement plan with guardrails that protect your lifestyle and give you confidence to spend wisely.

How Much Can You Safely Spend Each Year in Retirement?

Wondering how much you can safely spend in retirement? Learn why the 4% rule falls short, how the Retirement Spending Curve works, and strategies to enjoy your money without running out.

Why Southwest Washington Is the Best Place to Retire

Those of us in the Pacific Northwest know we’ve got something special. Here’s why Southwest Washington stands out as the top retirement spot on the West Coast.

Do You Have the Right Investment Strategy?

Too safe? Too risky? The right investment strategy strikes a balance.. is yours working for you?

The Great Retirement Debate: Pre-Tax or Roth?

One of the biggest financial questions people wrestle with is:

Should I put my money into a traditional (pre-tax) account, or a Roth account?

Let’s settle the debate.

Your Mid-Year Financial Planning Checklist for 2025

Take a few moments to check in now, so you can head into December confident you’re still on track.

Let’s review the eight key areas to assess.

How Much Should You Save for Retirement This Year?

Most people think about retirement savings as one big number or the total they’ll need by the time they stop working.

As a result, they often choose arbitrary contribution amounts for their 401(k)s and IRAs.

6 Overlooked Tax Planning Strategies for Retirees

When most people think about retirement, they focus on saving and investing, but not on how they’ll manage taxes in retirement.

That’s a problem. Because how you withdraw and distribute your wealth matters just as much as how you built it.

The Best Accounts to Fund if You Want to Retire Before 60

If early retirement is a goal of yours, whether that’s in your 50s or even sooner, traditional retirement accounts like 401(k)s and IRAs likely won’t be enough.

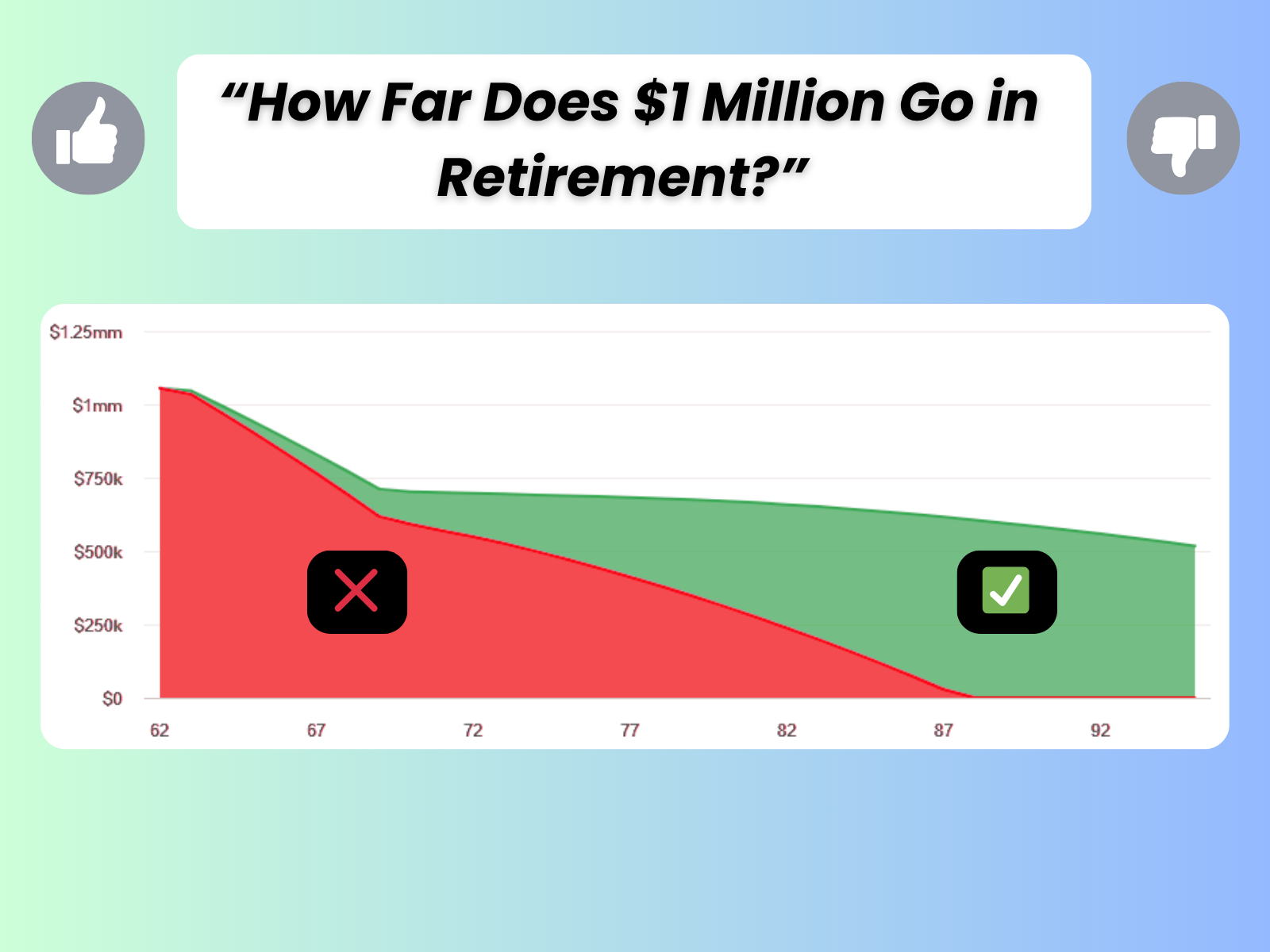

How Far Does $1 Million Go in Retirement?

We've been told for a long time that one million dollars is the mark to hit… but will it carry you all the way through retirement?

How to Talk to Your Aging Parents About Finances

Worried about your aging parents’ and their financial affairs, but not sure how to bring it up?

Here’s how to start the conversation, without making it awkward!

4 Areas of Focus in Your 50s Before Retiring

Your 50s are a crucial planning decade, arguably the most important for shaping your retirement years. Let’s talk about what you need to do to be financially successful in your 50s.