How Far Does $1 Million Go in Retirement?

We've been told for a long time that one million dollars is the mark to hit… but will it carry you all the way through retirement?

The following client example is specific to these two individuals and should not be taken and applied blindly as financial advice. Consult a credentialed professional about your specific situation.

For many approaching retirement, hitting the $1 million mark signals “mission accomplished” for retirement savings.

But with rising living costs, longer life expectancies, and unpredictable markets, it’s natural to wonder… is $1 million really enough anymore?

To make this more tangible, let’s look at a real-world scenario of a couple I recently helped model their retirement. Let’s call them Jeff and Janice.

Meet Jeff and Janice

Suppose that Jeff and Janice are 67 and have just entered retirement.

They’ve worked hard, saved diligently, and now want to enjoy life without worrying about outliving their money.

They have one simple question: “How far will $1 million go in retirement?”

That’s what we’ll attempt to answer together.

Their Financials

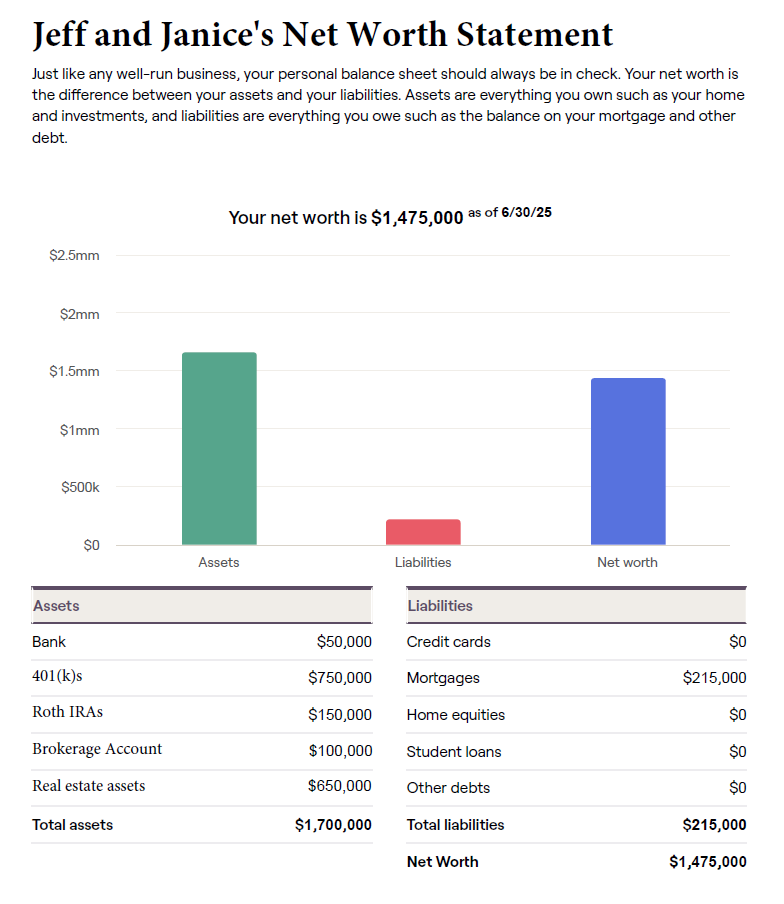

Here’s a look at their personal net worth statement:

Bank Savings: $50,000

401(k) Accounts: $750,000 (pre-tax)

Roth IRAs: $150,000

Brokerage Account: $100,000

Home Value: $650,000 (small mortgage remaining)

A few more relevant details:

They would like to maintain their standard of living, which for them has been a monthly spend of $7,000. That accounts for Medicare costs and travel.

Their mortgage payment ($1,000/mo.) drops off in 5 years.

They will are entitled to receive Social Security benefits of $4,500/month combined starting at age 67. If they wait to 70, they will receive $5,650/mo. They have decided to wait until age 70.

Assume future inflation is 3%.

They’re invested in a diversified portfolio of 75% stocks & 25% bonds, and they wish to continue this portfolio target model into retirement.

Plan for Long-Term Care Need of $100,000 per year for two years (their ages 85 & 86).

They are in good health and have longevity in their family history. Plan to live to age 95.

As we can see, between their 401(k)’s, IRAs and brokerage account, they have $1 million in investable assets.

The big question is: “Will it last?”

The Results: Will Jeff and Janice Be Okay?

It looks pretty good!

What we’re doing here is projecting their retirement 30 years into the future using all of the above details and assumptions, using 1,000 different investment return combinations.

81% of the time, they make it to age 95 with money left.

What If They Spend $1,000/mo. More?

Jeff and Janice feel pretty good about the above results.

Can they get away with spending $8,000/mo instead?

Well, it’s a coin flip.

53% of the time, they make it to age 95 with money left. The other half of the time, they don’t quite make it.

We don’t feel quite as comfortable with this.

Although it’s worth noting that small tweaks to their financial plan, such as increasing spending from $7,000 to $8,000 from age 65 to 75 before returning spending to $7,000/mo. at 76 (adjusted for inflation), results in a 70% probability of success.

This is the caveat with “probability of success” in financial planning.

We can easily (and would always) make small tweaks along the way to ensure that someone does not run out of money.

The Big Takeaway

So, can you make it through retirement with $1 million of investable assets? Sure, you can!

But it depends on how you answer the following questions, in addition to many others.

How much will you spend per month? $5,000/mo. or $10,000/mo.? Big difference..

What guaranteed income sources will you have in retirement? Just a small Social Security benefit or a Social Security, pension, and rental income?

Do you want to be generous to others? Yes or not at all..

As I’ve preached many times before, an arbitrary dollar figure saved, such as $1 million or $2 million, doesn’t mean much by itself.

Figure out what is right for you!