Three Questions to Ask Before Hiring a Fiduciary Advisor

Let’s be honest, the word “fiduciary” gets tossed around A LOT these days.

It sounds very reassuring, like a legal forcefield protecting you and your money.

But just because someone uses the word doesn’t mean they are technically a “fiduciary”. Let’s first talk about what this even means.

A fiduciary is an individual who is legally and ethically obligated to act in your best interest. In the financial context, this an advisor who even when it’s inconvenient or less profitable for them, is required to act in this way on your behalf.

In theory, that should make choosing an advisor simple. You would always select a fiduciary, however, in practice, it’s not that easy.

That’s because many financial advisors say they’re “fiduciaries” yet still operate within compensation models or business structures that indicate otherwise.

So before hiring a financial advisor, here are three questions that can help you cut through the noise and identify someone who understands you and your needs and who’s truly on your side.

Question 1: What experience and certifications do you have that help you work with clients like me?

The word fiduciary tells you someone is required to act in your best interest. It doesn’t tell you whether they actually know how to.

Ask an advisor about their background, not just how long they’ve been in the industry, but who they typically serve.

Are they experienced with retirees who have multiple accounts, complex tax situations, and estate goals?

Or do they mainly work with young professionals still building wealth?

You want someone who understands the specific challenges you face: coordinating taxes, managing RMDs, timing Social Security, planning charitable gifts, and structuring your portfolio for income rather than accumulation.

That kind of guidance only comes from experience with people at a similar life stage.

Credentials matter, too.

The Certified Financial Planner™ (CFP®) designation is often considered the gold standard because it requires years of coursework, a comprehensive exam, and adherence to a strict code of ethics. Beyond that, ongoing education in retirement income planning and tax strategy shows an advisor is committed to staying sharp as rules change.

The best fiduciaries combine both, expertise built through years of experience and a foundation of technical knowledge that ensures their advice isn’t based on guesswork.

Question 2: How are you compensated?

This is easily one of the most important questions you can ask, because it reveals their incentives or potential disincentives to be aligned with you.

Advisors generally fall into three categories:

Fee-only, fee-based, and commission-based.

A fee-only fiduciary is paid solely by the client, typically through a transparent percentage of assets under management, a flat fee, or an hourly rate. They don’t receive commissions or kickbacks from product providers.

Their advice isn’t influenced by which investments pay them more, because none of them do.

Fee-based advisors sound similar, but that tiny “based” makes a big difference. It usually means they charge a fee and can earn commissions from certain products. That dual structure often muddies incentives and can create conflicts of interest.

Commission-based advisors are paid entirely through product sales; insurance policies, annuities, or investment products. Their income depends on their transaction volume, not the outcomes of their clients.

When someone’s compensation depends on what you buy, they’re not a fiduciary, they’re a financial salesperson.

If you want a truly objective relationship, look for a fee-only fiduciary whose compensation comes from one place: you.

You can find competent fee-only professionals by doing a simple Google search: “fee-only financial advisors near me” or using a fee-only search directory such as National Association of Personal Financial Advisors (NAPFA), the Garrett Planning Network, or the XY Planning Network.

Question 3: How do you coordinate with my CPA and attorney?

Retirement planning doesn’t happen in silos.

Your investment strategy affects your taxes, your tax strategy affects your estate plan, and your estate plan determines what actually happens with the wealth you’ve built.

A true fiduciary acts as your “financial quarterback” making sure every professional on your team is working toward the same goals.

That means sharing information (with your permission), reviewing tax returns, and collaborating with your CPA and estate attorney to minimize blind spots and maximize after-tax outcomes.

If an advisor avoids coordination or says “that’s not my area,” it’s a sign they may be more focused on managing your portfolio than helping you manage all aspects of your financial life.

When all your professionals are aligned, you get more than a plan, you get expert coordination and peace of mind.

How to Verify if Someone Is Truly a Fiduciary

Asking the right questions is a great start, but it’s equally important to verify the answers and do the research.

Fortunately, you don’t have to take anyone’s word for it. A few minutes of online research can reveal whether an advisor really operates as a fiduciary and how they’re regulated.

1. Check the advisor’s background and disclosures.

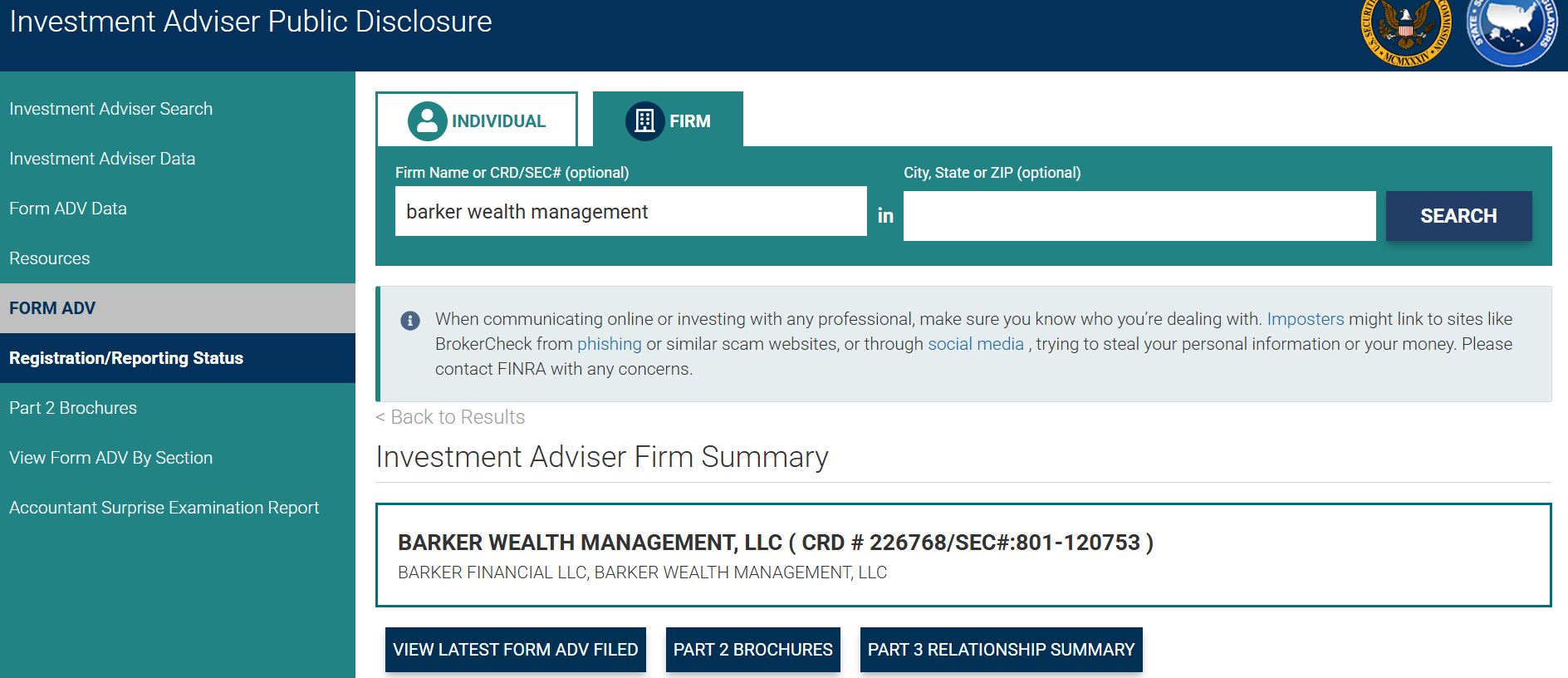

Visit BrokerCheck.org if the advisor is affiliated with a brokerage firm, or adviserinfo.sec.gov for registered investment advisory firms. Check both if you’re unsure of which to check.

There you can view an advisor’s work history, firm affiliations, regulatory oversight, and any disciplinary disclosures.

If they don’t appear in either places? That is incredibly concerning because that means that they are not licensed to provide advice for compensation.

2. Review their Form ADV Part 2A.

Every Registered Investment Advisor must file a public disclosure document called a Form ADV. You can find this when searching for a firm on the SEC Adviser website.

You should see a clickable box named “Part 2 Brochures”.

Part 2A of this form describes how the firm is compensated, the services it provides, and potential conflicts of interest.

It should clearly state whether the advisor is fee-only (paid exclusively by clients) or fee-based (may receive commissions).

If an advisor can’t or won’t provide their Form ADV 2A, or if it lists outside commissions or product affiliations, that’s a red flag.

3. Confirm independence.

A fiduciary advisor typically operates through a third-party custodian such as Charles Schwab or Fidelity, meaning your assets are held securely and separately from the advisory firm itself.

You should be able to verify that arrangement in both their Form ADV and on the custodian’s site.

Doing this research gives you the same view regulators have, and helps you move forward with confidence that your advisor’s structure truly supports your best interests.

That’s Just the Start!

A fiduciary standard should be the baseline, not the bragging point. But the word itself isn’t enough.

The way someone’s compensated, the type of clients they serve, how they collaborate with your other professionals, and how they’re regulated all reveal whether they truly walk the fiduciary walk.

Asking these three questions go a long ways towards helping you make an informed decision in who you entrust to help you.

A real fiduciary won’t just say they act in your best interest; their transparency, credentials, and public record will prove it.