Financially Speaking: The Blog

Retirement focused education to help you thrive.

The Best Accounts to Fund if You Want to Retire Before 60

If early retirement is a goal of yours, whether that’s in your 50s or even sooner, traditional retirement accounts like 401(k)s and IRAs likely won’t be enough.

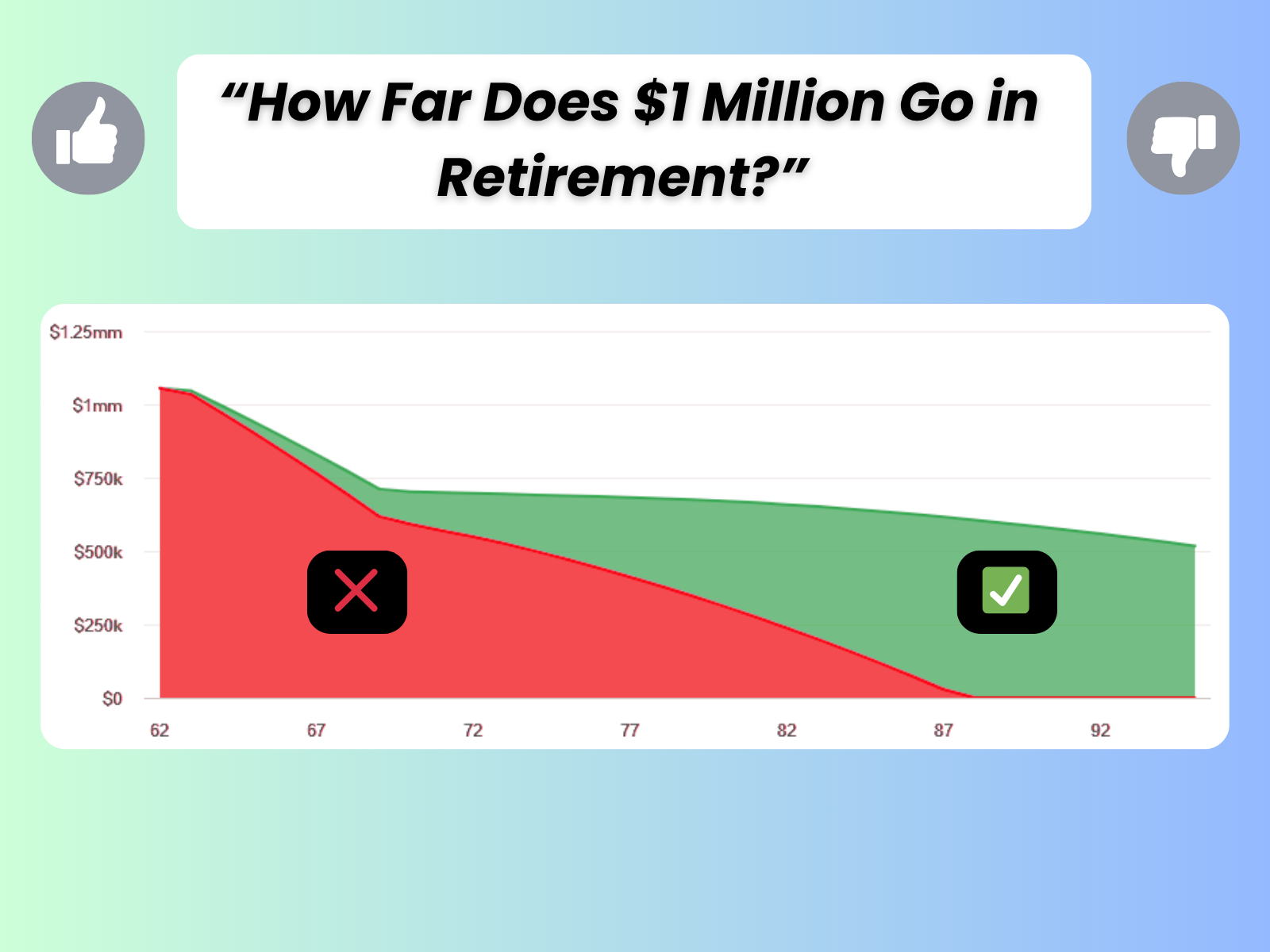

How Far Does $1 Million Go in Retirement?

We've been told for a long time that one million dollars is the mark to hit… but will it carry you all the way through retirement?

US Tax Laws Just Changed: Here’s How You’re Impacted!

The finalized One Big Beautiful Tax Bill is here.

Discover what’s changed, what’s staying the same, and how you should adjust your financial strategy.

Can the Right Financial Decision Feel Wrong?

Here’s a financial planner telling you it’s not all about what the numbers say is “best”.

Sometimes, the math points in one direction, but you’re compelled to go in another so that you can have peace of mind.

Do I Really Need a Financial Planner?

If you have the time, knowledge, and discipline, then maybe not.

However, there are some limitations to this approach that you should be aware of.

How to Talk to Your Aging Parents About Finances

Worried about your aging parents’ and their financial affairs, but not sure how to bring it up?

Here’s how to start the conversation, without making it awkward!

4 Areas of Focus in Your 50s Before Retiring

Your 50s are a crucial planning decade, arguably the most important for shaping your retirement years. Let’s talk about what you need to do to be financially successful in your 50s.

What I’ve Learned Helping People Retire

Throughout my career, I’ve had the privilege of guiding hundreds of families through the planning and transition into retirement.

Should You Take Social Security at 62, 67, or 70?

Before you claim your benefit as soon as you possibly can, consider the reasons why you might choose to wait.

What The US’ Proposed Tax Bill Could Mean For You!

A look into how this new proposed tax bill could affect you in 2025 and beyond.

Are You on Track? The Average Retirement Savings by 50 and 60

We’ve all wondered: “How does my retirement savings compare to everyone else’s?”

It’s a natural question and one that becomes more pressing as you approach your 60s.

Are You Taking Too Little Risk in Retirement?

In retirement, people’s main concern typically is “Will I run out of money?”

To mitigate this, people often take no risk to assure themselves of a successful retirement, when in reality, it could lead to the opposite outcome.

What to Do When You Inherit a Retirement Account

Inheriting a retirement account—whether it’s an IRA, Roth IRA, or 401(k)—often comes with mixed emotions. It can be a generous gift, the result of decades of saving and planning by a loved one. But without a clear understanding of how one inherits these accounts, it can also turn into a tax headache.

7 Reasons Why You Should Retire Early

Who doesn’t want to retire early? Let’s talk about 7 reasons to retire as quickly as you can.

Your 8-Step Financial Priorities Checklist!

Designed to answer the question: “Where should I be putting my money right now?”

4 Strategic Moves to Make While the Market Is Down

Who Actually Needs a Living Trust? (And Who Doesn’t!)

You’ve probably heard that you need a living trust—but is that really true?

Let’s talk about why that may or may not be the case.

10 Retirement Lessons You Can’t Afford to Ignore

If you nail these, you’re on your way to a successful, happy and fulfilling retirement!

8 Reasons Why People Seek My Help with Financial Planning

There's typically a triggering event that causes people to reach out for financial planning help.

Do any of these reasons resonate with you?

“Can I Retire at 63 with $1 Million?” - A Real Client Example

Congrats! You did the hard part. You saved and deferred into your retirement accounts for several decades but where are you really? Will you actually be able to retire when you are envisioning?